Top Elements Influencing Bankruptcy Discharge Singapore and Just How to Browse Them

Top Elements Influencing Bankruptcy Discharge Singapore and Just How to Browse Them

Blog Article

A Comprehensive Overview to Insolvency Discharge and Just How Expert Aid Can Ensure a Smooth Change

Browsing the complexities of personal bankruptcy discharge can be a daunting job for people seeking monetary alleviation. By checking out the importance of expert support in this matter, individuals can gain valuable understandings right into making best use of the advantages of personal bankruptcy discharge and eventually protecting a stable economic future.

Understanding Bankruptcy Discharge Process

The bankruptcy discharge process is a vital legal system that absolves a borrower from the commitment to settle certain financial obligations, giving them with a fresh financial begin. When a borrower efficiently completes the bankruptcy process, the court releases a discharge order that legally releases the individual from individual liability for specific financial obligations. This discharge prohibits creditors from taking any additional collection activities versus the debtor relevant to those financial obligations.

It is essential to note that not all debts are eligible for discharge. Specific commitments, such as youngster support, alimony, most tax financial obligations, and trainee finances, typically endure the bankruptcy procedure and remain the duty of the debtor. Additionally, any type of financial debts that the court determines were incurred through deceptive methods or destructive activities might also be exempt from discharge.

Comprehending the bankruptcy discharge procedure is necessary for debtors seeking relief with insolvency - bankruptcy discharge singapore. By understanding which financial debts can be discharged and which can not, individuals can make educated choices concerning their monetary future and work towards rebuilding their credit and attaining long-lasting financial stability

Eligibility Requirements for Discharge

Having actually made clear the debts that may or may not be released in bankruptcy, the focus moves to the certain eligibility requirements that determine which financial obligations can be absolved. The qualification requirements for discharge in bankruptcy differ depending upon the sort of bankruptcy filed. In a Phase 7 personal bankruptcy, which involves the liquidation of assets to settle lenders, people need to pass the methods examination to get approved for a discharge. This examination contrasts the debtor's income to the average revenue in their state and determines if they have the economic means to repay their debts. In addition, borrowers have to not have gotten a Chapter 7 discharge within the previous eight years or a Phase 13 discharge within the past 6 years to be qualified for another Phase 7 discharge.

On the other hand, in a Chapter 13 insolvency, which entails a repayment plan to creditors, individuals need to have a regular income source to get approved for a discharge. They must additionally have finished their repayment plan as outlined in the court-approved timetable (bankruptcy discharge singapore). Meeting these qualification requirements is critical for individuals looking for to have their financial obligations released via bankruptcy proceedings

Value of Professional Advice

Navigating the intricacies of personal bankruptcy legislations and procedures can be challenging, making expert support invaluable for people seeking financial debt relief with the discharge process. Insolvency regulations are intricate and differ depending upon the type of insolvency submitted, the jurisdiction, and private circumstances. Involving a qualified insolvency lawyer or economic expert can supply essential assistance in understanding the ins and outs of the procedure, making sure that all needed paperwork is submitted appropriately and promptly.

Expert assistance helps people make educated choices throughout the bankruptcy discharge procedure. Professionals can encourage on the most ideal kind of insolvency to file based upon the individual's financial situation, overview them via eligibility standards, and give insights on how to safeguard possessions during the discharge. In addition, professionals can represent customers in court, work out with creditors, and help establish a practical payment strategy if needed.

In addition, professional support can accelerate the personal bankruptcy discharge procedure, possibly decreasing the time and stress and anxiety entailed. By having a well-informed supporter on their side, individuals can navigate the link intricacies of insolvency with confidence, enhancing the probability of a successful debt relief end result.

Common Challenges to Prevent

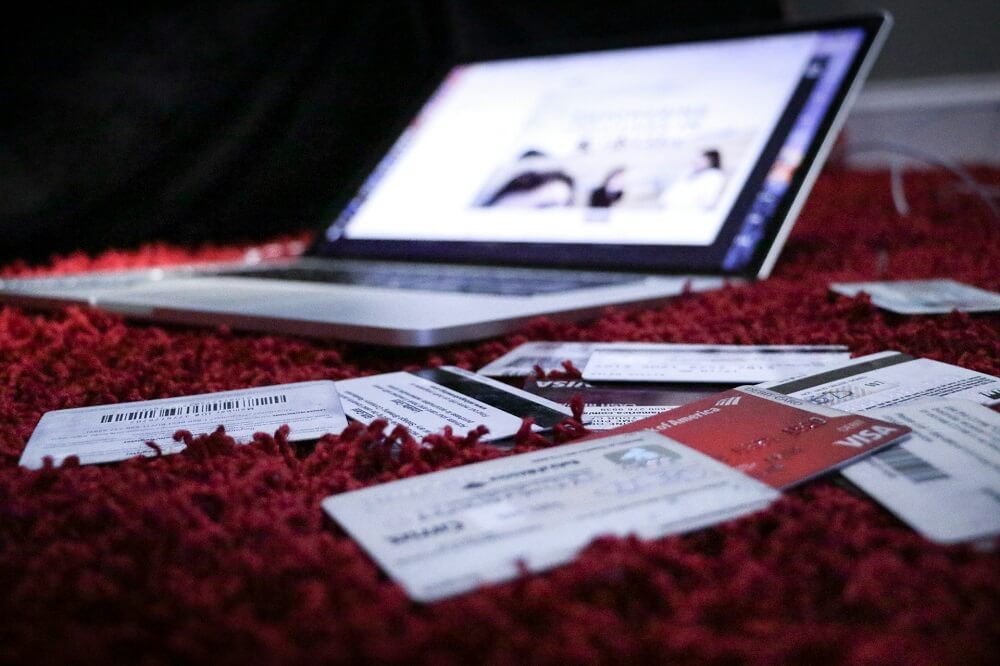

One more challenge to stay clear of is sustaining brand-new financial obligations shortly before applying for bankruptcy. Running up credit history card balances or obtaining lendings without intent of repayment can be seen as deceptive behavior by the court. Such actions might jeopardize the discharge of those debts or also the entire personal bankruptcy case.

In addition, disregarding to go to needed meetings or send necessary documentation on schedule can prevent the bankruptcy process. Missing due dates or visits can cause obstacles and prolong the time it requires to achieve financial debt relief. By remaining arranged, aggressive, and clear throughout the insolvency process, individuals can browse prospective mistakes and increase their chances of a successful discharge.

Taking Full Advantage Of Benefits of Discharge

After effectively steering clear of typical challenges that could hinder the bankruptcy discharge procedure, individuals can currently concentrate on optimizing the benefits of their discharge to safeguard a fresh financial begin. One vital aspect of making the most of the benefits of discharge is to carefully assess the regards to the discharge order. Recognizing what financial obligations have actually been released and which obligations continue to be can aid individuals intend their monetary future better.

Furthermore, people should take aggressive steps to reconstruct their credit report after receiving an insolvency discharge. This might include obtaining a protected charge card, making timely settlements, and keeping credit report usage low. By properly handling credit history post-discharge, individuals can gradually improve their credit rating and show economic duty to creditors.

In addition, looking for expert monetary guidance can be important in optimizing the advantages of a personal bankruptcy discharge. Financial advisors or credit history counselors can provide personalized advice on budgeting, saving, and rebuilding credit. Their experience can assist individuals make audio economic decisions and browse the path to a more stable economic future after personal bankruptcy.

Final Thought

To conclude, browsing the insolvency discharge process can be frustrating and intricate. Professional support is vital to guarantee a smooth shift and take full advantage of the benefits of discharge. By recognizing the qualification standards, preventing usual mistakes, and seeking professional aid, people can successfully navigate this tough economic scenario. It is important to come close to the personal bankruptcy discharge process with treatment and persistance to accomplish a clean slate and economic stability.

The eligibility standards for discharge in bankruptcy differ depending on the type of bankruptcy content submitted. Additionally, borrowers have to not have actually obtained a Phase 7 discharge within the previous eight years or a Phase 13 discharge within the previous six years to be qualified for an additional Phase 7 discharge.

Browsing the complexities of personal bankruptcy regulations and procedures can be difficult, making professional advice vital for individuals looking for financial debt alleviation via the find out this here discharge process.After effectively steering clear of common risks that could prevent the insolvency discharge process, people can now concentrate on making best use of the benefits of their discharge to safeguard a fresh monetary begin. One vital facet of taking full advantage of the advantages of discharge is to meticulously review the terms of the discharge order.

Report this page